what annual cash flows are necessary to justify the investment?

What is the Payback Flow?

The Payback Flow shows how long it takes for a business to recoup an investment. This type of assay allows firms to compare alternative investment opportunities and determine on a projection that returns its investment in the shortest time if that criteria is important to them.

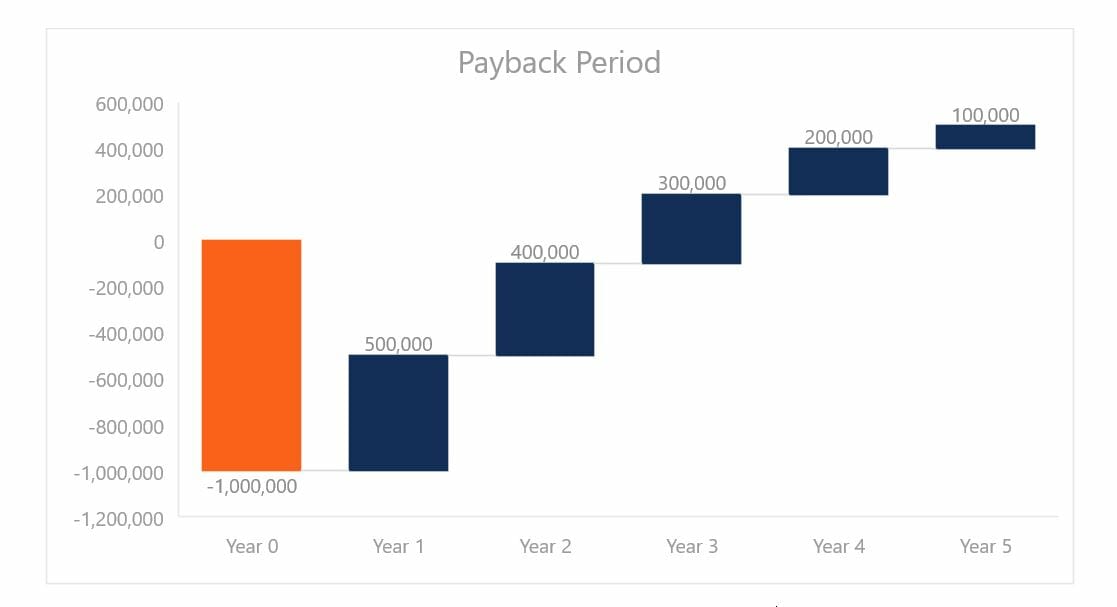

For example, a house may decide to invest in an asset with an initial cost of $1 million. Over the adjacent v years, the firm receives positive cash flows that diminish over time. What is the payback flow? As seen from the graph below, the initial investment is fully start past positive cash flows somewhere between periods 2 and 3.

Payback Period Formula

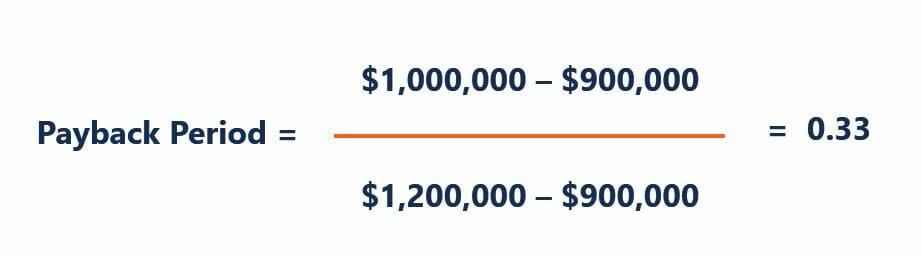

To find exactly when payback occurs, the following formula can be used:

Applying the formula to the example, we take the initial investment at its accented value. The opening and closing catamenia cumulative cash flows are $900,000 and $1,200,000, respectively. This is considering, every bit nosotros noted, the initial investment is recouped somewhere betwixt periods 2 and 3. Applying the formula provides the post-obit:

Equally such, the payback period for this projection is 2.33 years. The conclusion rule using the payback period is to minimize the time taken for the return of investment.

Download the Costless Template

Enter your name and email in the form below and download the costless template now!

Payback Period Template

Download the free Excel template now to accelerate your finance cognition!

Using the Payback Method

In essence, the payback menstruation is used very similarly to a Breakeven Analysis, but instead of the number of units to embrace stock-still costs, information technology considers the amount of time required to return an investment.

Given its nature, the payback menstruation is oftentimes used as an initial assay that tin can be understood without much technical knowledge. It is easy to calculate and is oftentimes referred to as the "back of the envelope" calculation. Also, information technologyis a elementary measure of take chances, as it shows how quickly money can be returned from an investment. Even so, there are additional considerations that should be taken into account when performing the majuscule budgeting process.

Drawback 1: Profitability

While the payback period shows united states how long information technology takes for the return on investment, information technology does not bear witness what the return on investment is. Referring to our example, greenbacks flows continue beyond period three, only they are not relevant in accordance with the decision dominion in the payback method.

Edifice on the previous case, the firm may accept a second choice of investing in another project that offers the following cash flows:

The other project would have a payback menstruum of 4.25 years but would generate higher returns on investment than the beginning project. However, based solely on the payback catamenia, the firm would select the get-go project over this alternative. The implications of this are that firms may choose investments with shorter payback periods at the expense of profitability.

Drawback 2: Risk and the Time Value of Money

Another issue with the payback period is that it does not explicitly discount for the risk and opportunity costs associated with the project. In some means, a shorter payback period suggests lower hazard exposure since the investment is returned at an earlier appointment. However, unlike projects may have exposure to different levels of risk even during the aforementioned period. Project gamble is frequently determined by estimating WACC.

Internal Rate of Return (IRR)

As an alternative to looking at how quickly an investment is paid back, and given the drawback outline above, information technology may be better for firms to await at the internal charge per unit of return (IRR) when comparing projects.

Financial analysts will perform financial modeling and IRR analysis to compare the attractiveness of unlike projects. Past forecasting free cash flows into the time to come, it is then possible to employ the XIRR function in Excel to make up one's mind what discount rate sets the Internet Nowadays Value of the project to nada (the definition of IRR).

Since IRR does non take hazard into account, it should be looked at in conjunction with the payback flow to determine which project is virtually bonny.

As you can see in the example beneath, a DCF model is used to graph the payback period (centre graph below).

Source: CFI Financial Modeling Courses online.

Related Readings

Cheers for reading CFI's guide to Payback Period. To go along learning and developing your skills, these additional costless CFI resource will exist helpful:

- Return on Investment

- Capital Nugget Pricing Model

- Analysis of Financial Statements

- Revenue Recognition Formula

Source: https://corporatefinanceinstitute.com/resources/knowledge/modeling/payback-period/

Post a Comment for "what annual cash flows are necessary to justify the investment?"